A startup incubator (or business incubator) is a structured support program, organization, or space designed to help very early stage startups launch, grow, and succeed.

Incubators often provide a bundle of resources: mentorship, training, office or lab space, administrative support, access to networks (investors, partners, professionals), business services (legal, accounting, marketing), and sometimes seed funding or connections to capital.

The idea is that by resolving or easing many of the early challenges (e.g. lack of domain knowledge, lack of network, high fixed costs), founders can focus more on innovation, product development, market validation, and growth.

Historically, incubators have been part of regional economic development initiatives or university innovation arms.

The first known “incubator” in business terms traces to the 1950s with the Batavia Industrial Center in New York. Over time, the model has proliferated globally across corporate, governmental, nonprofit, academic, and private sectors.

Why Do Startups Need Incubators?

Starting a new venture is fraught with risk, uncertainty, and resource limitations. Many startups fail simply due to avoidable mistakes, lack of guidance, or insufficient support. Incubators exist to bridge those gaps. Here are some key reasons:

1. Reduce Early Risk & Overhead Costs

Renting a good workspace, buying infrastructure (IT, office equipment, lab equipment), hiring support staff — all these expenses can drain cash. Incubators often provide subsidized or shared space, utilities, basic equipment, and administrative support (e.g. receptionist, HR, IT). This enables the startup to allocate more resources to core value-generation tasks.

2. Mentorship & Knowledge Access

Most incubators pair startups with experienced mentors — entrepreneurs, industry experts, technologists, legal/financial specialists. These mentors can advise on business model, fundraising, scaling, pitfalls, and strategy. The advice and “lessons learned” from those who’ve been there help reduce blind errors and accelerate growth.

3. Network & Credibility

Being accepted into a known incubator provides legitimacy. It signals to investors, customers, partners, and media that the startup has passed a vetting process. Incubators also bring curated networking events, investor pitch days, demo days, and access to partner networks.

4. Access to Capital & Follow-on Funding

Some incubators either invest directly, help with seed funding, or facilitate introductions to angel investors, VCs, or government grants. This can ease the path to your first funding round.

5. Structured Process & Accountability

Startups inside incubators often have check-ins, milestones, coaching, scheduled reviews, and frameworks to ensure progress. This discipline helps avoid drifting, wasted effort, or overconfidence. Many incubators require periodic deliverables or evaluations.

6. Peer Learning & Collaboration

By colocating startups or cohorts, incubators allow founders to learn from each other, share resources, cross-pollinate ideas, and collaborate. This “peer pressure + peer support” dynamic is often undervalued but powerful.

7. Longer Time Horizon

Unlike accelerators (which often demand rapid growth in fixed term), incubators tend to give startups more breathing space (months to years) to mature, pivot, or experiment before being pushed into scaling. This is especially helpful in domains where product development cycles are long (e.g. biotech, hardware).

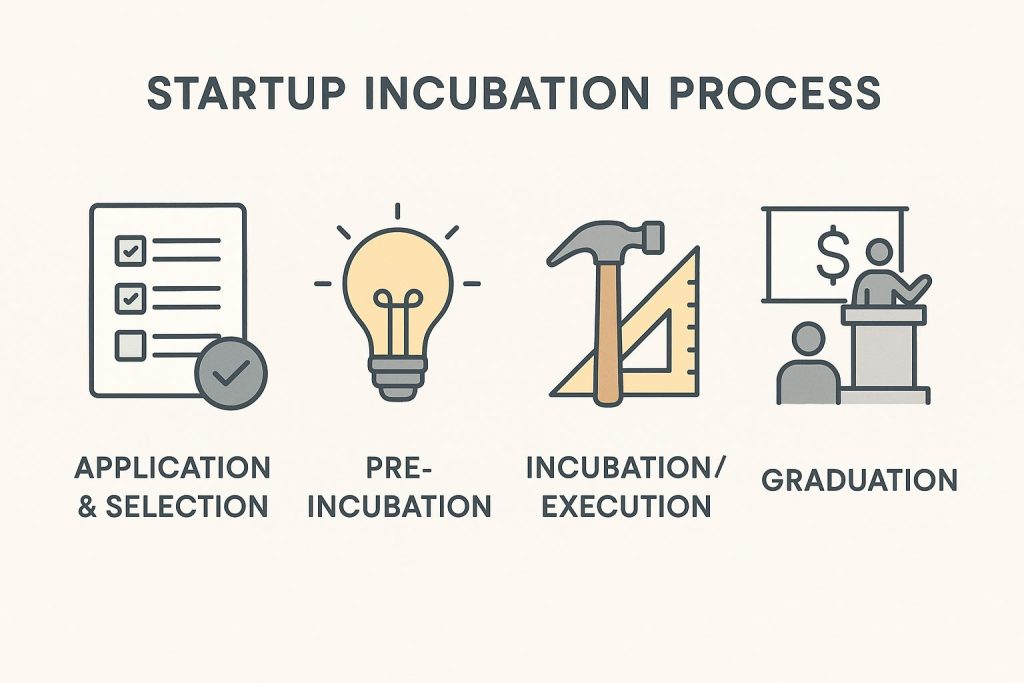

How Does an Incubator Work? Phases & Processes

A startup incubator’s “lifecycle” can be broadly divided into phases. The structure may differ across incubators, but the underlying progression often looks like this:

| Phase | Objective | Key Activities | Duration & Notes |

|---|---|---|---|

| Application & Selection | Incubator screens startups and selects those with potential | Submit application, pitch, interviews, due diligence | Many incubators have periodic calls; selection is competitive |

| Pre-incubation / Diagnostic | Validate idea, assess weaknesses, prepare the founder(s) | Market research, customer validation, business model canvas, foundational training, mentorship setup | This phase may last weeks to months |

| Incubation / Execution | Build and iterate the product or service, find product-market fit | Prototype development, pilot testing, marketing, sales, legal/regulations, team building | This can last many months to years, depending on domain |

| Graduation / Exit / Post-incubation | Transition startup to independent growth, scale, or external support | Investor pitch, scaling strategies, partnerships, IP commercialization, exit from subsidized support | Some incubators keep providing alumni support or follow-on resources |

Key Components During Incubation

- Milestones & Metrics: Incubators expect startups to hit agreed targets (e.g. number of users, revenue, partnerships).

- Mentor Check-ins: Regular sessions with advisors to review progress and unblock challenges.

- Workshops & Training Modules: Topics include lean startup, marketing, sales, finance, legal, soft skills, pitching.

- Peer Reviews / Cohort Sharing: Other incubated startups may present, critique, or share lessons.

- Resource Allocation: Access to software tools, shared lab space, prototyping facilities, cloud credits.

- Investor Demos / Pitch Day: At the end (or periodically), startups present to investors or external stakeholders.

From the BBVA perspective: incubator operations are categorized into orientation, training, and infrastructure — i.e., incubators help entrepreneurs define project objectives (orientation), provide specialized training (training), and give space and facilities (infrastructure).

Types of Startup Incubators

Not all incubators are the same. Their structure, focus, and business models vary widely. Some key classifications include:

By Sponsoring Entity / Ownership

- University / Academic Incubators (UBIs)

Operated by universities, often support student or faculty ventures. They may also link with research labs, technology transfer offices, and alumni networks. - Nonprofit / Government Incubators

Aimed at regional economic development, social entrepreneurship, or stimulus of innovation ecosystem. May emphasize inclusivity, underserved sectors. - Corporate / Industry Incubators

Run by corporations seeking to tap into external innovation, strategic partnerships, or new business development. These often align startups to the corporate’s domain or strategic goals. - For-profit / Private Incubators

Some incubators operate as private ventures and may take equity, charge fees, or generate returns via investments.

By Domain / Sector Focus

- Technology / Deep Tech Incubators

Focused on tech, software, hardware, IoT, AI, biotech, etc. These may often have specialized labs or equipment (e.g. clean room, wet lab). - Social / Impact Incubators

Focus on social enterprises, sustainability, non-profit models, community development. - Industry-specific Incubators

For example, agritech, healthcare, fintech, creative arts, food & beverage (e.g. kitchen incubators). Wikipedia even lists “kitchen incubator” as a business incubator type. - Virtual / Remote Incubators

Some incubators operate virtually, providing remote mentorship, online modules, with limited physical infrastructure. This model reduces overhead and enables global reach.

By Business Model / Funding

- Equity-based: The incubator takes a small equity share in exchange for services and support.

- Fee-based / Subscription: Startups pay a fee (monthly or fixed) for access to services/space.

- Grant / Subsidy-based: Funded by government or philanthropic grants; startups might get free access or subsidized support.

- Royalty / Revenue-share model: Incubators take a percentage of revenue or royalties.

- Pay-it-forward models: Alumni or graduates contribute support or funds to next cohort.

The Business Incubator Wikipedia page categorizes incubators by types such as academic, nonprofit development, for-profit property ventures, and venture capital–affiliated.

Incubator vs Accelerator vs Venture Studio: Clarifying Confusion

Because “incubator,” “accelerator,” and “venture studio” (or venture builder) are often used interchangeably in casual conversations, it’s important to clarify distinctions, especially for SEO clarity and educating your readers.

Incubator vs Accelerator

- Stage of Startup:

Incubators typically cater to very early-stage or idea-stage startups (sometimes pre-product). Accelerators often require startups to have some traction, a team, or an MVP. - Duration & Pace:

Incubation periods are flexible (months to years). Accelerators operate on fixed, short-term cohorts (e.g. 3–6 months) with a push to scale quickly. - Capital Investment:

Accelerators usually offer seed funding in exchange for equity (e.g. $20k–$150k). Incubators may or may not invest; when they do, it’s often smaller or via follow-on rounds. - Goal & Focus:

Incubators focus on nurturing, maturation, experimentation, and risk mitigation. Accelerators emphasize growth, scaling, and preparing for investment.

Venture Studio / Startup Studio

A venture studio (also called startup factory or venture builder) is an organization that actively builds startups in-house rather than accepting external applications. In a venture studio model, the studio ideates, validates, hires teams, and launches multiple startups concurrently.

Some differences:

- Studios often own majority equity from inception.

- They do not function like external incubator/accelerator programs with cohorts; instead, they build ventures internally.

- Studios can be more resource-intensive and hands-on in direct product development.

So: incubators help external founders; accelerators accelerate those founders; studios create startups from within.

Pros & Cons of Startup Incubators

Every model has tradeoffs. Here’s a balanced view to help readers and founders decide:

Benefits (Pros)

- Lower operating cost & risk

Shared infrastructure and support reduce the burn. - Faster learning curves & better decisions

Mentors and peer support help avoid mistakes and redirect early. - Credibility / Validation

Being accepted into a reputable incubator boosts your standing with stakeholders. - Better access to capital and partners

Warm intros to investors, corporate partners, government programs. - Structured momentum & accountability

Helps startups maintain focus rather than drifting. - Domain expertise & domain networks

Incubators often have specialization, which gives domain-specific edges.

Challenges & Limitations (Cons)

- Selection is competitive

Many quality incubators have strict vetting and limited slots. - Time commitment & constraints

Some incubators expect you to relocate, attend sessions, meet KPIs, abide by program rules. - Equity or cost tradeoffs

If the incubator demands equity or fees, that dilutes the founding stake or adds burden. - Misalignment

The incubator’s domain, goals, or values may not align well with the venture. - Dependency risk

Founders might lean too heavily on incubator support, failing to build independent capabilities. - Opportunity cost

Time in incubation is time not spent fully in the market — need to validate it’s worth the trade.

HubSpot also outlines how incubators have downsides (e.g. selective barriers, program constraints) while being valuable for early-stage founders.

Thus, founders must weigh whether an incubator enhances their path more than it limits flexibility or equity.

What Do Incubators Look For When Selecting Startups?

It’s critical to guide readers what incubators expect in applications. Typical selection criteria include:

- Founding Team

Experience, passion, domain knowledge, complementary skills, and commitment matter heavily. - Idea / Problem-Solution Fit

The startup should address a real, validated problem. Some early traction or proof-of-concept is beneficial. - Scalability / Market Opportunity

Incubators prefer startups with potential for growth, large addressable markets, or disruptive innovation. - Business Model & Monetization

The plan for how the startup will earn revenue or sustain itself is essential. - Technology / Innovation / Differentiation

The idea should show some unique edge — technology, intellectual property, defensibility. - Use of Resources

Incubators evaluate whether the startup will use their resources (mentorship, space, networks) effectively. - Founder Commitment & Vision

Founders must display long-term commitment, resilience, and a clear vision. - Fit with Domain / Focus of the Incubator

Some incubators have vertical specialization; your startup should align. - Milestones & Growth Plan

A roadmap of short-term and medium-term goals helps convince incubators that progress is possible.

How to Choose the Right Incubator (For a Startup Founder)

Choosing the “wrong” incubator can waste time or lead to misalignment. Here are guidelines:

- Domain & Focus Match

If you’re in fintech, an incubator strong in fintech is better than a general-purpose one. - Reputation, Track Record & Alumni Success

Check former cohort startups — how many survived, scaled, raised funds, exited. - Mentor Quality & Network Strength

The quality and relevance of mentors, advisors, and investor connections matter more than flashy perks. - Terms & Equity / Fee Structure

Understand what you’re giving up (equity, royalties, fees) and whether it’s reasonable. - Duration & Flexibility

See whether the incubation period, attendance demands, and timelines fit your pace. - Resources & Infrastructure

Does the incubator offer what you need (lab, co-working, prototyping, cloud credits, legal, marketing)? - Geographic & Remote Considerations

If the startup must be in a specific geography (for operations, markets, regulation), choose a local incubator or one with remote flexibility. - Post-graduation Support

Does the incubator help with alumni support, fundraising, office continuation, or network access after graduation? - Cultural Fit & Values

The incubator’s culture, work style, values should align with your team’s style. - Exit / Graduation Criteria

Understand how and when you’ll “graduate” from the incubator and what support continues afterward.

When Should a Startup Join an Incubator? Timing & Readiness

It’s not always optimal for a startup to blindly enter an incubator at the earliest possible moment. Here are some guidelines on timing and readiness:

- Very early stages / ideation: If your idea is nascent, with little validation, an incubator can help you shape it.

- After preliminary validation: If you’ve done some customer discovery, prototype, or traction, incubator support becomes more useful.

- Before burning cash: If your runway is short, joining an incubator can stretch resources via subsidized support.

- Before scaling: When you have the MVP and are ready to scale, an incubator can help with structuring and investor intros.

- Avoid too early commitment: If your idea is fundamentally unshaped or you are still exploratory, entering an incubator prematurely can be distracting.

Be cautious not to view the incubator as a crutch. Your startup must still build independent capabilities and be ready to operate once support is withdrawn.

Case Examples & Success Stories

Including real-world examples helps with E-E-A-T (experience, authority). Here are a few:

- Airbnb, Dropbox — both are frequently cited among startups that benefited from incubator-like support ecosystems.

- i-Hub Gujarat (India) — a startup incubator in India under the Gujarat government. It supports student and early ventures, providing workspace, mentorship, and funding assistance.

(You can also incorporate local/regional incubator startups in your geography to boost relevance and authenticity.)

FAQ Section

Q1: Do incubators always take equity in startups?

A: No. Some incubators do take equity, but many do not. Some operate on grants, subsidies, fees, or sponsorship models. Always read the terms.

Q2: Is an incubator the same as an accelerator?

A: No. Incubators generally nurture early-stage startups over longer periods; accelerators push growth in a fixed, intense timeframe.

Q3: How long do incubator programs last?

A: There is no fixed duration — anywhere from 6 months to 2–3 years, depending on domain and maturity.

Q4: Can startups outside of the incubator’s location join virtually?

A: Some incubators operate virtually or have hybrid models. But geographic proximity is often advantageous for networking, mentorship, and infrastructure access.

Q5: What happens after graduation?

A: Startups “graduate” when support ends. Good incubators continue alumni support, facilitate funding, or retain access to services.

Conclusion

Startup incubators represent one of the foundational pillars of the innovation ecosystem — serving as specialized environments where early-stage ideas can be nurtured, tested, refined, and launched.

By offering mentorship, infrastructure, networks, and structured support, incubators help mitigate the inherent risks of founding a startup.

However, incubators are not magic wands. Their benefits must outweigh the costs (equity, time, constraints), and the fit between startup and incubator must be intentional.

Founders should evaluate domain alignment, reputation, mentor quality, resource offerings, and terms.