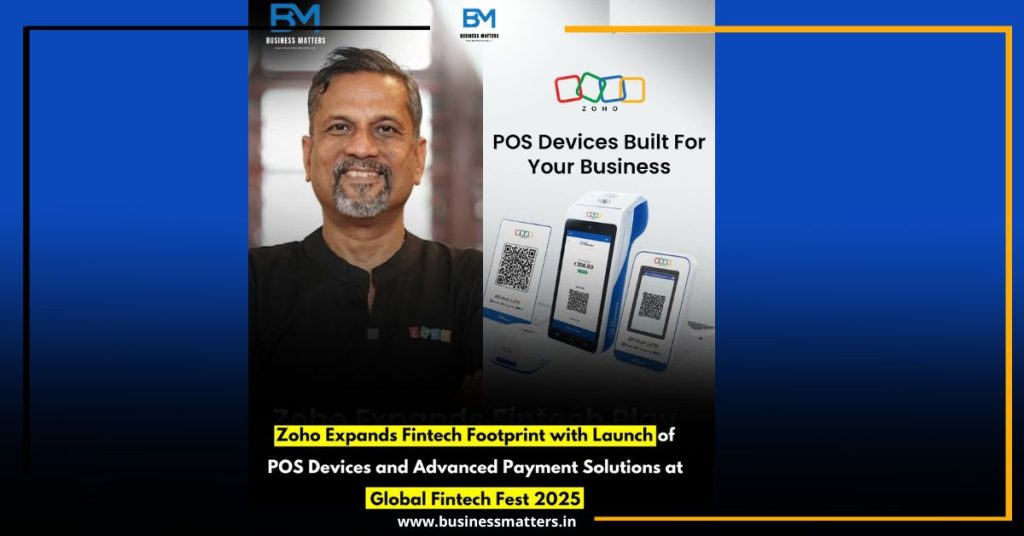

Indian SaaS unicorn Zoho has officially entered the hardware-based fintech space with the launch of a comprehensive suite of point-of-sale (POS) devices under its Zoho Payments brand. Announced by cofounder Sridhar Vembu on X (formerly Twitter), the move marks a significant expansion of Zoho’s fintech offerings, aimed at strengthening digital payment adoption across India.

At the Global Fintech Fest 2025 in Mumbai, Zoho unveiled its innovative POS solutions that include:

- All-in-one POS systems

- Smart POS devices

- Static QR codes integrated with soundbox technology

These devices are designed to cater to the diverse payment needs of small businesses, retailers, and enterprises, offering seamless digital transactions and real-time customer engagement.

Zoho Teams Up with NPCI Bharat BillPay Ltd

In a strategic collaboration, Zoho has partnered with NPCI Bharat BillPay Ltd (NBBL) to enhance India’s digital payments infrastructure. This partnership aims to solve real-world business challenges through robust, scalable payment solutions, contributing to the government’s vision of a cashless economy.

The initiative aligns with Zoho’s broader mission of enabling digital transformation for Indian businesses by offering affordable, locally-developed technology.

Zoho Pay to Integrate with Arattai, Taking on WhatsApp Pay

As part of its fintech innovation, Zoho is working on integrating its payment platform, Zoho Pay, with its homegrown instant messaging app Arattai. This integration will allow users to send and receive money directly through the app, offering a seamless and secure experience similar to WhatsApp Pay.

With Arattai-Pay integration, Zoho aims to capture a significant share of the growing peer-to-peer (P2P) payments market, especially in Tier 2 and Tier 3 cities, where digital messaging and mobile payments are rapidly growing.

Advanced Payment Features for Businesses

In addition to POS hardware, Zoho introduced a suite of new payment solutions tailored for business needs:

- Payouts for vendors, employees, and partners

- Virtual accounts for easy and automated collections

- Marketplace settlements to streamline revenue sharing and reconciliation

These tools are designed to help businesses automate financial workflows, reduce manual errors, and improve cash flow visibility.

Zoho Payroll Integration for Salary Disbursements

A major highlight is the integration of Zoho Payments with Zoho Payroll, enabling companies to automate salary disbursements. This feature helps businesses:

- Track and manage employee payments efficiently

- Ensure compliance with statutory regulations

- Minimize administrative burden through automation

Strengthening the Digital Economy

Zoho’s continued focus on building a Made-in-India digital ecosystem reflects its commitment to empowering local businesses with end-to-end technology solutions. The new POS devices and fintech features position Zoho as a strong competitor to established players like Razorpay, PhonePe, and Paytm in the digital payments space.

As India’s fintech sector continues to evolve, Zoho’s strategic product launches and partnerships demonstrate its vision to become a key enabler of digital finance across the country.