RBI rate cuts and startup funding are closely connected in India’s current economic environment.

When the Reserve Bank of India reduces interest rates, it affects startup loans, venture debt,

and investor risk appetite.

This article explains how RBI rate cuts influence startup funding, especially for early-stage and tier 2–3 founders.

Understanding RBI Rate Cuts in Simple Terms

To understand RBI rate cuts and startup funding, founders need to look beyond headlines and focus on how monetary policy changes capital availability.

For startups, this does not automatically mean more venture capital, but it changes the funding environment in important ways.

These changes align closely with broader startup policy changes 2026 India that aim to improve capital access and reduce financial friction.

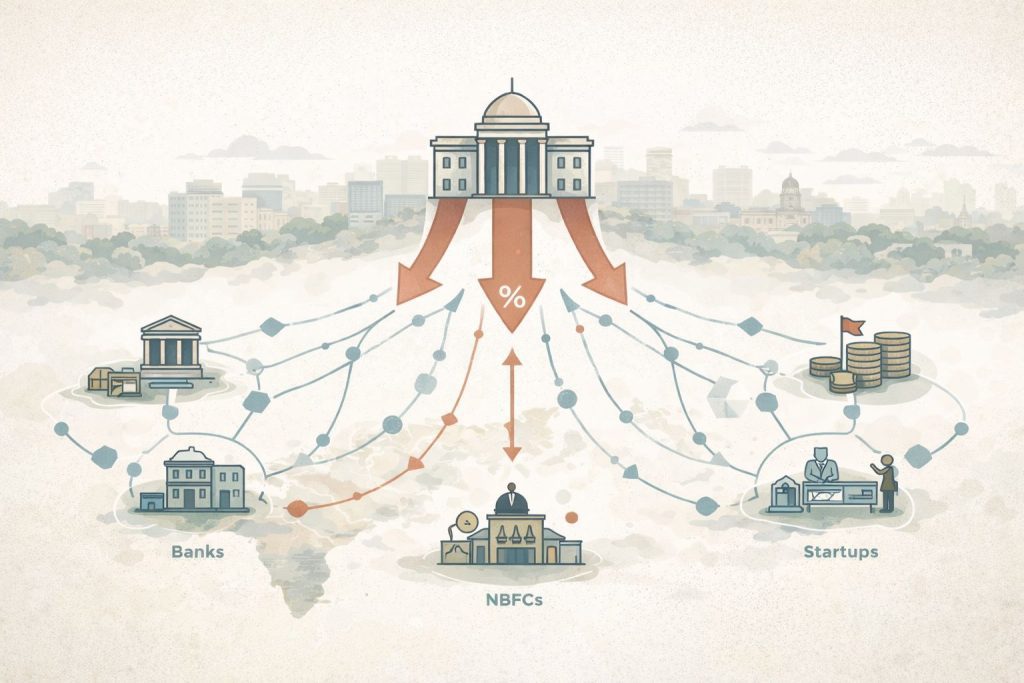

How RBI Rate Cuts and Startup Funding Are Connected in India

Direct Impact: Cost of Capital Comes Down

Lower RBI rates reduce the base lending rates for banks and NBFCs. This directly impacts:

- Working capital loans

- Term loans

- Venture debt products

- Overdraft facilities

For startups that rely on debt alongside equity, this can meaningfully reduce monthly burn.

Indirect Impact: Investor Behaviour Shifts

Interest rate cuts also influence where investors allocate capital.

When rates are high:

- Fixed-income instruments look attractive

- Risk appetite drops

When rates fall:

- Investors seek higher returns

- Equity and startup investments become more appealing

This creates a friendlier funding environment, though not instant funding.

Impact on Venture Debt and Startup Loans

One of the clearest beneficiaries of RBI rate cuts is venture debt.

Why Venture Debt Becomes More Attractive

- Lower interest rates reduce repayment pressure

- Longer runways for revenue-generating startups

- Better alignment with equity fundraising timelines

For founders who are not ready to dilute equity, venture debt becomes a strategic bridge, not a last resort.

RBI Rate Cuts and Tier-2 & Tier-3 Startups

The impact of rate cuts is often stronger outside metro cities.

Why?

- Tier-3 founders rely more on bank credit than VCs

- Local NBFCs become more flexible when rates fall

- Credit access improves faster than equity access

This is especially relevant for founders featured in tier 3 founder journeys India, where capital efficiency and disciplined growth matter more than rapid fundraising.

How RBI Rate Cuts Affect SME-Startup Hybrids

Many startups in India begin as SMEs before scaling into venture-backed businesses.

Lower interest rates help these businesses by:

- Improving working capital cycles

- Reducing stress on GST and tax-related outflows

- Making expansion loans more viable

This complements the benefits discussed under SME tax reforms FY26, where compliance simplification improves cash flow predictability.

What RBI Rate Cuts Do NOT Do

There is a lot of misunderstanding around rate cuts.

RBI rate cuts do not:

- Guarantee VC funding

- Force investors to fund startups

- Automatically increase valuations

Funding still depends on:

- Business fundamentals

- Revenue visibility

- Market opportunity

- Founder execution

Rate cuts only improve the environment, not outcomes.

Strategic Opportunities for Founders During Rate Cuts

Smart founders use rate-cut cycles strategically.

What Founders Can Do

- Refinance high-interest debt

- Explore venture debt options

- Extend runway without dilution

- Improve unit economics before fundraising

Founders who prepare during low-rate cycles are better positioned when investor sentiment turns positive.

Sector-Wise Impact of RBI Rate Cuts

SaaS & Tech Startups

- Better access to venture debt

- Improved global competitiveness

Manufacturing & D2C

- Cheaper inventory financing

- Easier expansion into new regions

Services & Local Businesses

- Lower working capital costs

- Improved survival rates

Frequently Asked Questions

How do RBI rate cuts affect startup funding?

RBI rate cuts reduce borrowing costs, improve liquidity, and increase investor risk appetite, making debt and equity funding more accessible for startups over time.

Do RBI rate cuts help early-stage startups?

Yes. Early-stage startups benefit through cheaper loans, venture debt options, and improved cash flow, even if VC funding remains selective.

Are Tier-3 startups more impacted by rate cuts?

Yes. Tier-3 startups depend more on bank and NBFC credit, so lower interest rates have a more immediate impact compared to metro startups.

Do rate cuts increase startup valuations?

Not directly. Valuations depend on growth, revenue, and market size. Rate cuts only create a more supportive funding environment.

Key Takeaways

- RBI rate cuts reduce startup borrowing costs

- Venture debt becomes more attractive

- Tier-2 and Tier-3 startups benefit more

- Funding conditions improve gradually, not instantly

- Execution still matters more than policy

Actionable Steps for Startup Founders

- Review existing loan interest rates

- Explore refinancing or venture debt

- Strengthen cash flow discipline

- Delay dilution if debt is cheaper

- Prepare for fundraising in advance

Conclusion

RBI rate cuts influence startup funding by improving liquidity, lowering debt costs, and gradually increasing investor appetite for risk. While they do not guarantee funding, they create conditions where disciplined startups—especially those in Tier-2 and Tier-3 cities—can grow with greater financial stability. Founders who understand and act on these shifts gain a meaningful strategic advantage. The relationship between RBI rate cuts and startup funding is indirect but important for founders who rely on loans, venture debt, and long-term capital planning.