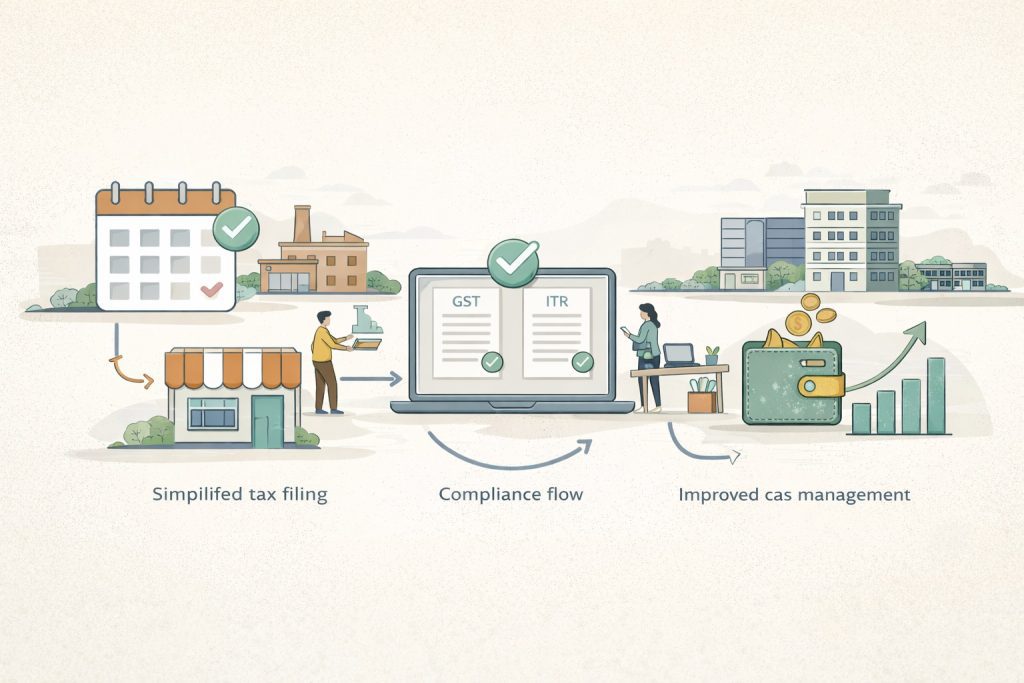

SME tax reforms FY26 refer to the latest tax-related changes impacting small and medium enterprises in India, aimed at simplifying compliance, improving cash flow, and reducing filing complexity. These reforms affect GST processes, income tax reporting, and compliance timelines—directly shaping how SMEs operate, plan finances, and scale sustainably.

Understanding SME Tax Reforms FY26 in India

SMEs are the backbone of India’s economy, but tax compliance has traditionally been complex and time-consuming. SME tax reforms FY26 focus on making compliance practical rather than punitive, especially for growing businesses transitioning from informal operations to structured systems.

These reforms align closely with broader national efforts under startup policy changes 2026 India to create a more predictable and founder-friendly business environment.

Why SME Tax Reforms FY26 Matter for Small Businesses

Most SMEs struggle not because of high tax rates, but due to:

- Complicated filing structures

- Frequent reporting requirements

- Cash flow blockages caused by delayed credits

SME tax reforms FY26 aim to reduce these friction points so business owners can focus on operations, customers, and growth, rather than paperwork.

Key SME Tax Reforms FY26 Explained Clearly

1. Simplification of Compliance Processes

One of the most practical outcomes of SME tax reforms FY26 is reduced compliance friction.

What this means for SMEs:

- Clearer reporting requirements

- Fewer interpretational grey areas

- Lower dependence on consultants for routine filings

This is particularly important for SMEs that operate with lean teams and limited financial staff.

2. GST Process Improvements for SMEs

GST compliance has been one of the biggest operational challenges for small businesses. Under SME tax reforms FY26, the focus is on simplification rather than expansion.

Key improvements include:

- Easier return structures

- Reduced reconciliation complexity

- Better clarity on eligible credits

For SMEs that also interact with startups and digital businesses, these GST improvements complement reforms seen across the tier 3 founder journeys India where lean compliance is critical for survival.

3. Presumptive Taxation Benefits Continue

Presumptive taxation remains a powerful tool under SME tax reforms FY26, especially for small service providers and traders.

Benefits include:

- No requirement for detailed books (within limits)

- Predictable tax outflow

- Faster filing process

This model works particularly well for SMEs operating in Tier-2 and Tier-3 regions.

Income Tax Reporting: What SME Owners Should Watch

While tax rates remain largely stable, reporting clarity has improved.

SME tax reforms FY26 emphasize:

- Better separation of personal and business income

- Cleaner disclosure formats

- Reduced duplication across filings

This reduces the risk of errors that often trigger notices or audits.

How SME Tax Reforms FY26 Improve Cash Flow

Cash flow is the lifeline of small businesses. These reforms support liquidity by:

- Reducing compliance-related delays

- Improving predictability of tax obligations

- Encouraging timely credit processing

For SMEs working on tight margins, certainty matters more than marginal tax savings.

Practical Impact Across Different SME Types

Manufacturing SMEs

- Better planning for working capital

- Improved credit clarity

- Lower compliance stress

Service-Based SMEs

- Presumptive taxation advantages

- Simplified reporting

- Lower audit exposure

Digital & Platform SMEs

- Clearer treatment of online revenue

- Improved GST alignment

- Reduced ambiguity in inter-state transactions

These changes collectively strengthen India’s broader business ecosystem.

Common Mistakes SMEs Should Still Avoid

Even with reforms, some risks remain:

- Missing filing deadlines

- Incorrect GST classification

- Mixing personal and business expenses

- Ignoring reconciliation requirements

SME tax reforms FY26 simplify processes, but discipline is still essential.

Frequently Asked Questions (AEO Optimised)

What are SME tax reforms FY26?

SME tax reforms FY26 are changes introduced to simplify tax compliance, improve cash flow, and reduce reporting complexity for small and medium enterprises in India.

Do SME tax reforms FY26 reduce tax rates?

No. The focus is on simplifying compliance and improving clarity, not on reducing headline tax rates.

Are these reforms helpful for small and Tier-3 businesses?

Yes. SMEs in smaller cities benefit significantly from reduced compliance burden and clearer filing requirements.

Do these reforms apply to startups as well?

Yes. Many startups that began as SMEs are directly impacted, especially those aligned with

startup policy changes 2026 India.

Key Takeaways

- SME tax reforms FY26 focus on clarity and execution

- Compliance is simpler, not eliminated

- Cash flow predictability improves

- Presumptive taxation remains valuable

- These reforms support long-term SME sustainability

Actionable Steps for SME Owners

- Review your current compliance structure

- Separate business and personal finances clearly

- Check eligibility for presumptive taxation

- Maintain quarterly compliance discipline

- Align tax planning with growth goals

Conclusion

SME tax reforms FY26 represent a shift toward practical, business-friendly taxation in India. By reducing friction and improving clarity, these reforms help SMEs operate with confidence and plan growth more effectively. Businesses that adapt early will gain operational stability and long-term resilience in a rapidly evolving economic environment.